Addressing Your Questions About WCMSA as Part of TPOC Reporting

by J. Shymanski

The Centers for Medicare & Medicaid Services (CMS) announced earlier this year that starting on April 4, 2025, additional information would be required as part of the Section 111 Mandatory Insurer Reporting of Total Payment Obligation to the Claimant (TPOC) Reporting. As there has been much confusion in the industry about what changed and what did not, we clarify the new requirements in the following Q&A.

Q: Does CMS now require submission of Medicare Set-Sides (MSAs) for all Medicare beneficiaries?

A: No. Submission of an MSA to CMS for review/approval has been and continues to be a voluntary process[1]:

There are no statutory or regulatory provisions requiring that you submit a Workers’ Compensation Medicare Set-Aside (WCMSA) amount proposal to CMS for review. If you choose to use CMS’ WCMSA review process, the agency requests that you comply with CMS’ established policies and procedures.

Q: Did the requirements for submission of an MSA to CMS change?

A: No. Cases submitted to CMS must still meet one of the two workload review thresholds outlined in Section 8.1 of the WCMSA Reference Guide:

-

-

- The claimant is a Medicare beneficiary and the total settlement amount is greater than $25,000.00; or

- The claimant has a reasonable expectation of Medicare enrollment within 30 months of the settlement date and the anticipated total settlement amount for future medical expenses and disability or lost wages over the life or duration of the settlement agreement is expected to be greater than $250,000.00.

-

Q: What has changed for Medicare beneficiary cases with respect to CMS?

A: As of April 4, 2025, CMS requires additional information (seven additional data fields) as part of TPOC for Section 111 Mandatory Insurer Reporting.

Q: Is this additional information required on all cases?

A: No. The additional data fields are only required for:

-

-

- For workers’ compensation cases

- For TPOCs on cases that meet the Section 111 Mandatory Insurer Reporting requirements[2]

-

Q: When is Section 111 Mandatory Insurer Reporting required and what is Total Payment Obligation to the Claimant (TPOC)?

A: Section 111 of the Medicare, Medicaid, and SCHIP Extension Act of 2007 (MMSEA Section 111) adds mandatory reporting requirements with respect to Medicare beneficiaries who have coverage under group health plan (GHP) arrangements, and for Medicare beneficiaries who receive settlements, judgments, awards or other payment from liability insurance (including self-insurance), no-fault insurance, or workers’ compensation.[3]

The Total Payment Obligation to the Claimant (TPOC) amount refers to the dollar amount of a settlement, judgment, award, or other payment in addition to or apart from ORM. A TPOC generally reflects a “one-time” or “lump sum” settlement, judgment, award, or other payment intended to resolve or partially resolve a claim. It is the dollar amount of the total payment obligation to, or on behalf of the injured party in connection with the settlement, judgment, award, or other payment.[4]

Q: Am I required to report all workers’ compensation TPOCs?

A: No. As of January 1, 2025, CMS will maintain the $750 threshold for workers’ compensation settlements, where the workers’ compensation entity does not otherwise have ongoing responsibility for medicals. Responsible Reporting Entities (RREs) may submit TPOCs that are less than or equal to the TPOC dollar threshold and will not be penalized for doing so.[5]

Q: What additional information is required as part of Section 111 Mandatory Insurer Reporting?

A: For any settlement reached on or after April 4, 2025, RREs are required (as a component of their Section 111 reporting obligations) to report the amount of any WCMSA created as part of a workers’ compensation settlement.

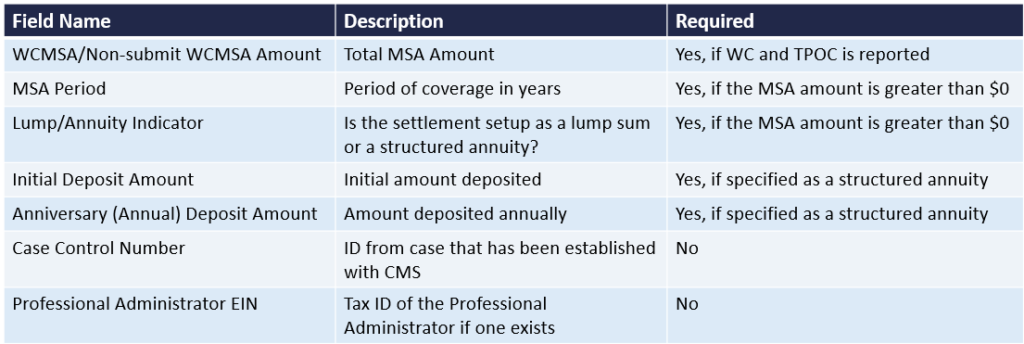

Q: What specifically are the additional data fields?

A: There are five required fields and two optional fields as described in the table below:

We understand that each case is unique and understanding how to address Medicare Secondary Compliance issues can be challenging and even frustrating at times. If you have additional questions about reporting WCMAs, or would like to learn more about how our experienced team can guide you through the reporting process, please contact us at [email protected].

[1] WCMSA Reference Guide version 4.3 Section 1.0

[2] NGHP User Guide Chapter III Policy: Section 6.4.4.1

[3] NGHP User Guide Chapter I Introduction; Chapter 5

[4] NGHP User Guide Chapter III Policy; Section 6.4

[5] NGHP User Guide Chapter III Policy; Section 6.4.4