CMS Advances Rulemaking for Section 111 Civil Money Penalties and Future Medicals

By F. Fairchok

Last week, the Centers for Medicare & Medicaid Services (CMS) advanced the rulemaking process in two long-awaited areas. The Regulation Identifier Numbers for “Medicare Secondary Payer and Future Medicals” (0938-AT85) and “Medicare Secondary Payer and Certain Civil Money Penalties” (0938-AT86) were advanced to the Office of Management and Budget (OMB) for review of the final rule.

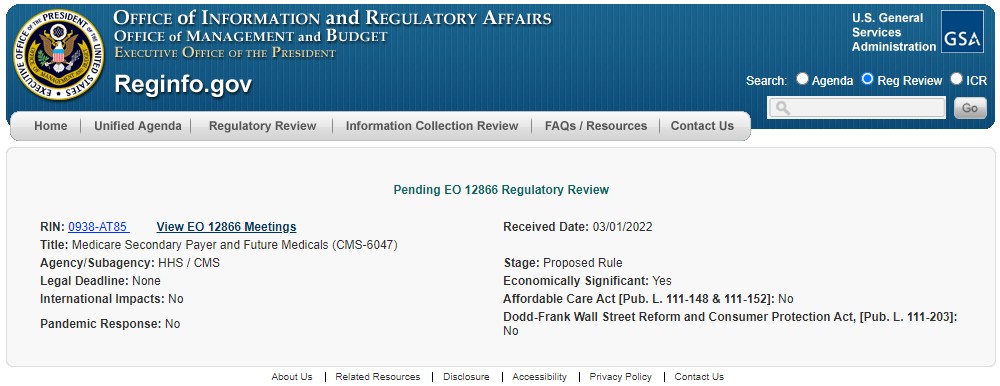

0938-AT85 – Medicare Secondary Payer and Future Medicals (CMS-6047)

The latest abstract for this rule states:

“This proposed rule would clarify existing Medicare Secondary Payer (MSP) obligations associated with future medical items services related to liability insurance (including self-insurance), no fault insurance, and worker’s compensation settlements, judgments, awards, or other payments. This proposed rule would also remove obsolete regulations.”

We have seen this rule moved on the Unified Agenda for several years since 2018, with the abstract language remaining consistent since early 2020. However, in 2021 the abstract was edited to remove the following statement:

“Specifically, this rule would clarify that an individual or Medicare beneficiary must satisfy Medicare’s interest with respect to future medical items and services related to such settlements, judgments, awards, or other payments.”

While the expectation is that the rule would address future medicals for liability insurance, the rule will likely also address future medicals for all Non-Group Health Plan (NGHP) areas.

Figure 1 – 0938-AT85 (Click image to go to website)

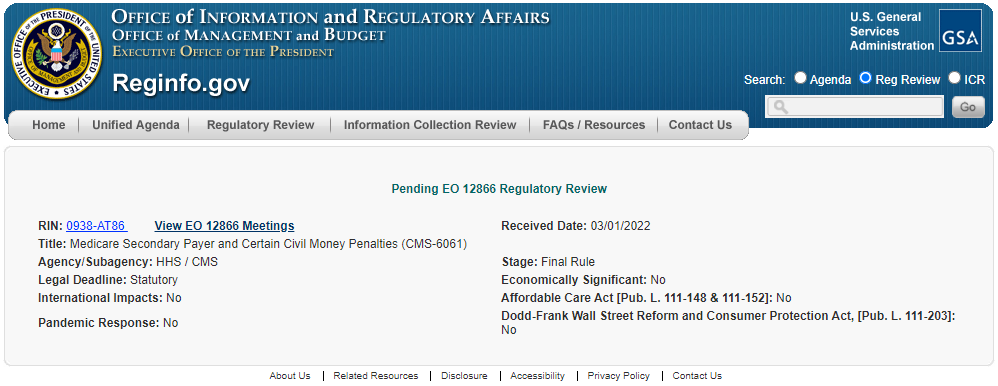

0938-AT86 – Medicare Secondary Payer and Certain Civil Money Penalties (CMS-6061)

The latest abstract for this rule states:

“This final rule specifies how and when CMS must calculate and impose civil money penalties (CMPs) when group health plan (GHP) and non-group health plan (NGHP) responsible reporting entities (RREs) fail to meet their Medicare Secondary Payer (MSP) reporting obligations in any one or more of the following ways: when RREs fail to register and report as required by MSP reporting requirements; when RREs report as required, but report in a manner that exceeds error tolerances established by the Secretary of the Department of Health and Human Services (the Secretary); when RREs contradict the information the RREs have reported when CMS attempts to recover its payments from these RREs. This rule also establishes CMP amounts and circumstances under which CMPs would and would not be imposed.”

Rulemaking around Civil Money Penalties for Section 111 Reporting originally started after the SMART Act was passed in December 2013 with an Advanced Notice of Proposed Rulemaking (ANPRM). After closure of the ANPRM commentary period in February 2014, there was no activity until publication of a proposed rule in February 2020 with another commentary period ending on April 20, 2020. CMS received 46 unique submissions of feedback for the latest commentary period, including many detailed responses. It is interesting to note that although CMS provided specific areas of interest to review for penalization, few details were provided as to the mechanics of how they would calculate such penalties.

Figure 2 – 0938-AT86 (Click image to go to website)

Figure 2 – 0938-AT86 (Click image to go to website)

Commentary

Movement towards final rules in the areas of future medicals and Section 111 penalties should not come as a surprise to frequent readers of our blog. First and foremost, we urge our clients to stay well informed in this area and to prepare as thoroughly as possible for further developments.

For Section 111 Civil Money Penalties, MEDVAL advises that all Responsible Reporting Entities (RREs) evaluate their reporting processes from start to finish. This recommendation holds true even if your reporting is being handled outside of your organization, by Reporting Agents (RAs) or Third-Party Administrators (TPAs), for example. We suggest that you ask the following questions regarding your process:

- Are our quarterly submissions receiving SP disposition codes or hitting the 20% error threshold?

- Do we report TPOCs and ORM timely to CMS?

- Are data elements, including ICD codes, accurately being reported? (Have you been submitting corrected claims via your Section 111 reporting after issues have been identified in the Conditional Payment process?)

The cost of not completing a process and data review could quickly and easily eclipse the cost of committing additional resources to fine-tuning your procedures.

Impaxx will continue to closely monitor rulemaking for these items and bring you the latest news and updates. We can also address your questions about compliance in these areas, so don’t hesitate to reach out to us at [email protected].