CMS Discusses Section 111 Best Practices and More on NGHP Webinar

Updated: 01/06/25

– CMS provided an updated link to slides from their September 12 webinar on the What’s New page of the Mandatory Insurer Reporting for NGHP section on CMS.gov. Q&A responses have been added the PDF of the webinar slides.

Updated: 9/20/24

– CMS provided a link to slides from their September 12 webinar on the What’s New page of the Mandatory Insurer Reporting for NGHP section on CMS.gov.

On September 12, 2024, CMS hosted another Section 111 Non-Group Health Plan (NGHP) webinar. While CMS did not discuss Civil Money Penalties (CMPs) in detail, they did state that they would be hosting a separate webinar in October to specifically address CMPs. They also reminded participants that any questions regarding CMPs should be sent to [email protected] and reinforced the importance of accurate reporting to reduce the risks of CMPs.

During the webinar they shared Section 111 best practices, discussed upcoming changes involving the expansion of Total Payment Obligation to Claimant (TPOC) to include Workers’ Compensation Medicare Set-Aside (WCMSA) information and a conducted a question-and-answer session. Below are some highlights from the session.

Section 111 Best Practices

CMS reminded participants how to calculate TPOC amounts for settlements, judgements, awards or other payments stating that TPOC should include, but not be limited to: Medicare and Non-Medicare covered medical expenses, indemnity payments, attorneys’ fees, Medicare Set-Aside amounts, the payout total (not the amount paid for) annuities, settlement advances, amounts forgiven by the carrier, and lien payments.

CMS also reinforced the criteria for reporting TPOC noting that TPOC should not be reported unless all of the following criteria are satisfied:

-

- The alleged injury/individual claimant (s) have been identified;

- The TPOC amount has been determined; and

- The Responsible Reporting Entity (RRE) knows when the TPOC will be funded.

Specific examples were also discussed including mass tort situations where all claimants or settlement amounts have not been identified and the settlement of lost wages only, which does not trigger TPOC reporting. CMS indicated that if the wage loss portion of the claim is settled first and medicals are settled later in a separate settlement, the amount of the wage loss settlement is not included in the TPOC calculation.

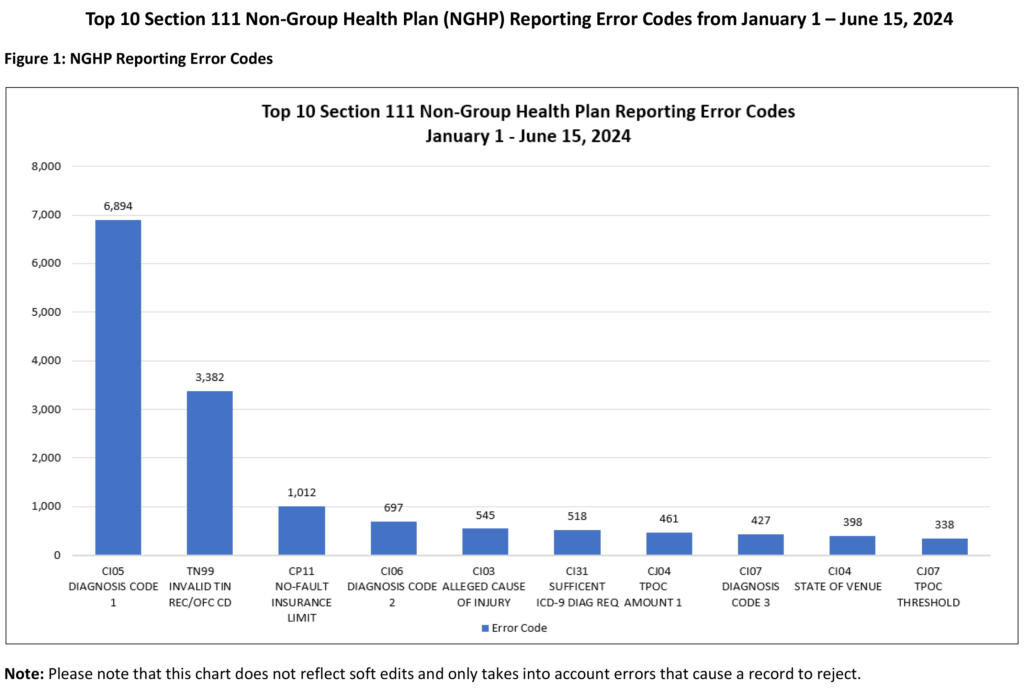

CMS also reviewed various disposition codes, and the top 10 error codes as noted in the chart below.

Over 6,000 errors form January 2024 and June 2024 involve the CI05 error code which is the first ICD code field reported on the file. CMS mentioned that the most common reasons for this error are the field being left blank, using invalid codes, or improper formatting. CMS also reviewed additional errors including TIN reference, additional ICD code fields, ORM, TPOC and no-fault amounts. A full list of error codes can be found in Chapter V of the NGHP User Guide. CMS noted that hard errors will cause the record to be rejected and emphasized that errors must be corrected and resubmitted to CMS.

CMS then reviewed the four key reporting fields and the delete and add process. These fields include the CMS date of incident, plan insurance type, policy number, and ORM indicator. CMS noted that these fields should be kept up to date and the add and delete functions should only be used for these key fields. They also reviewed the steps to take in the event the RRE changes reporting agents and highlighted the need to inform and work with your EDI representative on these changes.

Upcoming Changes

In addition to featuring updates to the COBSW website, CMS discussed the upcoming changes to TPOC reporting, which will require the inclusion of WCMSA information beginning April 4, 2025. CMS noted that submission of the data should be done regardless of whether the WCMSA is submitted to CMS as part of the voluntary review process. They again emphasized that submission of a WCMSA is not required under the law.

Next, CMS addressed specific WCMSA reporting scenarios. If a claim includes both a workers’ compensation and a liability component and there is a global settlement, the entire settlement amount is considered part of the workers’ compensation case. In most cases, the WCMSA period included in the new TPOC reporting fields will be for the life of the claimant, but there may be some exceptions based on certain things, such as state law. For cases where ORM remains open for part of the claim, RREs should report TPOC and edit ORM to reflect only those body parts that remain open.

Testing for the WCMSA changes will begin on October 7, 2024, and the RRE’s EDI representative is the primary contact for testing. Details on testing can be found in Chapter IV of the NGHP User Guide.

Additional Resources/Questions and Answers

CMS provided additional resources for RREs including the following:

-

-

- The EDI Department is available for assistance at (646) 458-6740.

- For additional S111 information:

-

-

-

- Section 111 NGHP User Guide

- Section 111 NGHP Training Materials

- Section 111 Mailbox: [email protected]

-

3. WCMSA questions should be submitted to: [email protected].

Questions included reporting TPOC in a wrongful death claim. CMS representatives stated that if no medical is released as part of the settlement, and no medicals are claimed, the claim would not need to be reported.

TPOC questions also include what constitutes “amounts forgiven by the carrier” and lien payments as part of the TPOC calculation. CMS gave the example of a self-insured hospital forgiving a medical bill as part of settlement, which should be considered in the TPOC amount and when the RRE agrees to pay for provider liens as part of settlement, which should also be included in the TPOC amount.

Additional Thoughts

With looming CMPs and upcoming TPOC reporting changes, Section 111 Reporting continues to become more and more complex. Assessing your current process, fixing any issues, and providing ongoing support for reporting is imperative to help limit your risk and exposure.

IMPAXX has an entire suite of Section 111 services to help you meet your reporting requirements. With comprehensive training programs, ongoing consultation services, Section 111 audits, a state-of-the-art reporting platform, Direct Data Entry assistance, safe harbor solutions, and settlement review for reporting requirements, we are here to help you with all aspects of the reporting process.

If you have any questions about the recent CMS webinar or would like more information about our comprehensive compliance services, please contact the Settlement Consulting team at [email protected].