Key Takeaways from CMS’ NGHP Reporting Webinar

by F. Fairchok

CMS hosted a webinar on December 6, 2022, to discuss best practices for Section 111 Reporting for Non-Group Health Plan (NGHP) entities. The one-hour webinar began with a series of slides presented containing best practice and general reminders, and then turned the focus to a question-and-answer session to round out the hour.

Update: The presentation slides from the webinar are now available in the Download area of the What’s New page of the Mandatory Insurer Reporting (NGHP) section at cms.gov.

Some of the more notable topics presented included the following reminders:

-

- The accuracy of your Section 111 Reporting is important because it has a direct relationship to the accuracy of related recovery processes.

- TPOC amounts may consist of all Medicare covered and non-covered medical expenses, indemnity payments, attorney fees, set-aside amount (if applicable), payout totals for all annuities, settlement advances, amounts forgiven by the carrier or insurer, and any lien payments.

- Clarification that indemnity only settlements that do not settle medicals do not need to be reported as a TPOC. If there are indemnity payments included in a settlement where medicals are released, they would be included in the calculation of the TPOC.

- The Event Table in Section 6.6.4 of Chapter 4 of the NGHP User Guide should be used to help to determine how to report for a wide range of scenarios. CMS covered two of these scenarios during the webinar as follows:

-

- A claim that has a change where ORM ends for one injury without settlement, but continues for another, should be modified using the “update” action type where only the remaining injury codes are sent, removing the ICD codes for the resolved injuries. The ORM flag remains set to “Yes” and no ORM termination date is entered.

-

IMPAXX commentary on this item: timing is critical here as CMS will not have a specific date for which the RRE is no longer responsible for resolved injuries. CMS will only know that codes that existed within the ORM report have been removed when the quarterly claim file is received.

-

-

-

- A claim where multiple injury codes were reported with open ORM where a portion of them terminate with a settlement while others remain open is more complex. In this case, the original reported claim is updated removing the codes included in the settlement. A second record is then reported as an “add” record that includes the injury codes settled along with the TPOC information and is reported with ORM equal to “No”.

-

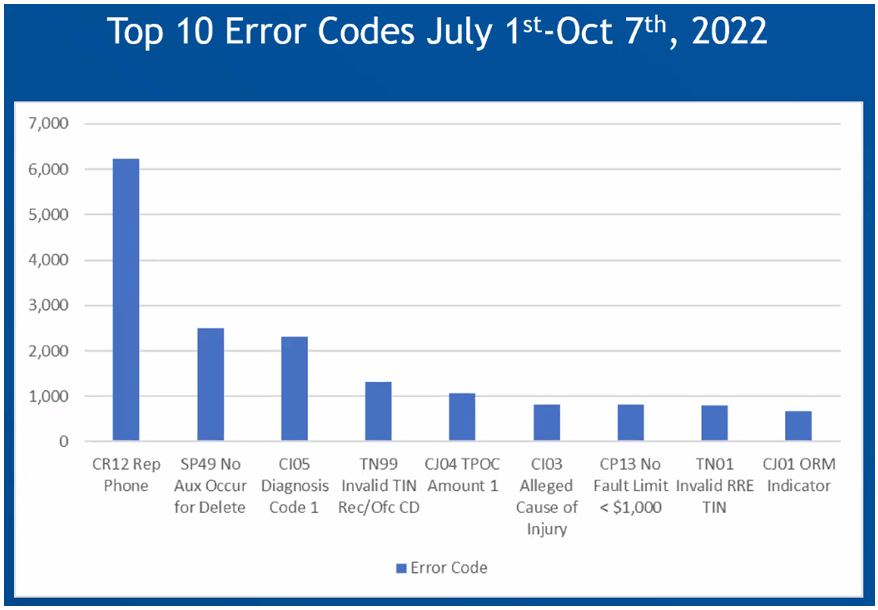

- CMS presented the “Top 10 Error Codes July 1st – Oct 7th, 2022” slide indicating the following codes:

-

- CR12 – Rep Phone

- SP49 – Aux Occur for Delete

- CI05 – Diagnosis Code 1

- TN99 – Invalid TIN/Office Code Combination

- CJ04 – TPOC Amount 1

- CI03 – Alleged Cause of Injury

- CP13 – No Fault Limit <$1,000

- TN01 – Invalid RRE TIN

- CJ01 – ORM Indicator

-

-

Figure 1- Top 10 Error Codes – Source: CMS Reporting Webinar, Dec 6, 2022

For the “Top 10 Error Codes,” only nine codes were presented on the screen. However, it is important for us to recommend that RREs review their reporting results closely to achieve a high claim acceptance rate for their quarterly reporting submission to CMS. Errors that prevent a claim from being accepted could cause an error threshold to be met, resulting in the file being rejected. Hitting this threshold has been indicated as a potential area of interest in the Civil Money Penalties rulemaking for which we are currently waiting to see further movement.

Another item that was noteworthy from the webinar is an upcoming change to No-Fault error code CP13. Currently, this soft error code is triggered when a no-fault insurance limit is less than $1,000. In January 2023, the limit will be decreased to $500. This item may give us a hint that either an NGHP User Guide update or alert will be forthcoming in January.

Lastly, the presentation included several slides around reporting activities to be completed when changing reporting agents or third-party administrators (TPAs). These slides presented some assumptions about such moves and the composition of previously reported claims. In one scenario presented, the advice given is for the TPA from which the claims are transferring to send deletes, and for the new TPA to send add records for the purpose of updating the policy number. However, with many years of experience in this area, I believe that doing this blindly would present several issues for both the RRE and the TPAs. While each TPA handles claims their own way, there are many considerations, such as the new TPA having to report claims that may have been administratively closed for years. Transfers need to be carefully evaluated from all angles, and RREs need a solid plan that assures data is not lost, and that the new TPA can properly update, or delete and add, claims that were previously reported for their RRE clients.

IMPAXX continuously monitors all areas of Medicare Secondary Payer compliance including all the detail involved with Section 111 Reporting. If you have questions about the information presented on the CMS webinar today or the points outlined above, please reach out to us at [email protected]